If you’re like most people, you pay some attention to the housing prices in your neighborhood and how they’re changing. The internet makes this easy, with sites like Zillow keeping track of listings. But what do you do if you want to see how expensive your neighborhood was decades ago, in the pre-internet era?

Right now, any historical look at housing prices requires using a patchwork of datasets, some of which have significant limitations (for a long explanation of issues with historical housing price data, see here: click).

But thanks to a new grant awarded to economics professor Allison Shertzer, historical housing data will soon be getting a major improvement.

Important questions seeking better data

For most Americans, housing represents the largest expenditure each year, typically accounting for between 30 and 40 percent of annual spending. By comparison, that’s about as much as the next three highest sources of spending – food, transportation, and healthcare – combined.

In addition to being the largest source of spending, housing also represents an important investment; American households have more money invested in their primary residencies than in retirement accounts or financial assets (e.g. stocks and bonds).

These features make housing important to understanding long-run economic questions at both the household and economy-wide level. At the household level, housing prices affect how households make decisions about things like work, raising children, and retirement. At the economy-wide level, changes in housing prices affect how economists calculate measures of living standards, and make judgements about economic progress.

Shertzer, whose research uses historical episodes to learn about public goods and cities, says that the improved data will also help economists understand how cities came to be. “The 1880 to 1930 period is especially important in the formation of US cities, and with better data economists can understand this crucial period of urbanization,” said Shertzer.

When Shertzer’s project, which has a timeline of three years, is complete, it will produce a data set spanning 1890-1990, with quarterly price data for 20 large US cities, and annual price data for 30 smaller cities. The data will be public, serving as a resource to academics everywhere.

Building the data is laborious, and the grant, which comes from the National Science Foundation, has allowed Shertzer to recruit Pitt students to help the venture.

I get by with a little help

From 1890 to 1990, local and city newspaper classifieds were the dominant way to advertise housing sales. Recently, these classified sections have been digitized and made available through online sources, providing the basis for Shertzer’s data collection.

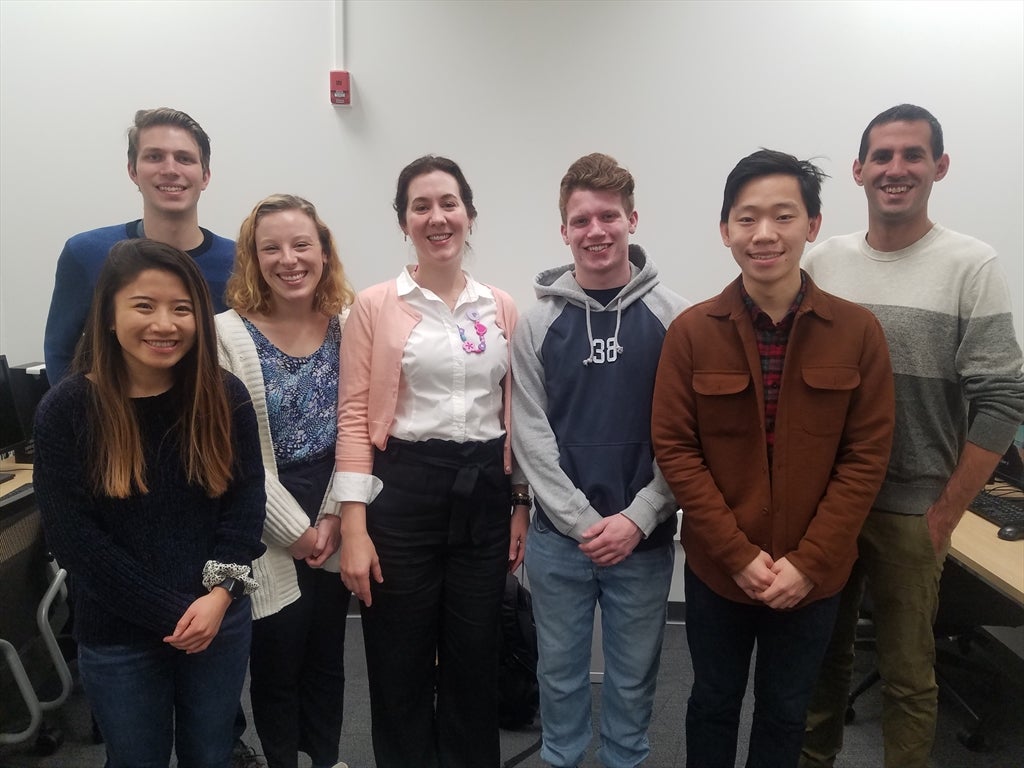

With the grant’s funding, five Pitt undergraduate students and one graduate student were hired as Research Assistants (RAs) to work on the data collection. Four of the RAs are tasked with combing through the digitized real estate listings and recording a listing’s information in a database. The remaining RA has been working with economics PhD student Michael Coury to geocode the properties. Geocoding syncs a property’s address with its physical location on the earth’s surface, which makes it possible to draw maps of where properties are relative to one another.

To recruit RAs, Shertzer emailed Pitt undergraduate economics majors and met with them to gauge their interests. “The students are all smart,” Shertzer said, “but it was also important for me to find RAs with a genuine interest in cities.”

The undergrad RAs began work in January, and Shertzer is already impressed by their contributions. She credits members of the Dietrich School’s IT staff – especially Gene Vercammen – for helping the project get off the ground quickly, as coordinating the intense data collection required significant technical help.

That Shertzer and Co. were able to start early in the semester became a godsend when Pitt announced the suspension of all on-campus meetings and work in response to COVID: Shertzer said her team has had little trouble making progress during the past month.